Budget Tools & Resources

Explore practical tips, tools, and strategies to help you build a budget that actually fits your life — whether you’re just getting started or refining your system.

Budget Tracking Methods

Budgeting is a personal journey with no one-size-fits-all approach. Whether you prefer writing, using an app, or creating a spreadsheet, there are many options to suit your style.

Budget Planners:

You can either designate a notebook as your financial planner or purchase one that already has the budget template set up, allowing you to get started right away. A budget planner is ideal for those who prefer to write everything down. Keep your budget planner in a safe location so you can refer back to it when it's time for a check-in. Consider using budget planners like the Clever Fox Budget Planner.

Budget Mobile Apps:

Mobile apps often come with a subscription, but it may be worth subscribing to them to help you manage your finances. Budgeting apps allow you to connect your bank account and categorize your expenses, enabling you to visually track where your money is going. This can help you make better financial decisions. Consider using apps like Monarch Money, YNAB, or Quicken Simplifi.

Budget Spreadsheets

Using budgeting spreadsheets is an effective way to track your expenses. They are customizable, allowing you to tailor categories and set spending limits. If you are familiar with Excel or Google Sheets, you will find spreadsheets to be very effective. You can create your own, or you might consider trying our FWL Budget Planner Spreadsheet, which offers pre-set categories and formulas to help you manage your budget efficiently.

Download

Budgeting Downloads

Enhance Your Financial Management with Our Essential Budgeting Tools!

Monthly Budget Worksheet (Spreadsheet)

This spreadsheet helps you track monthly expenses in categories like housing, transportation, and food. By entering daily expenditures, you can gain insights into your spending habits and find areas to save.

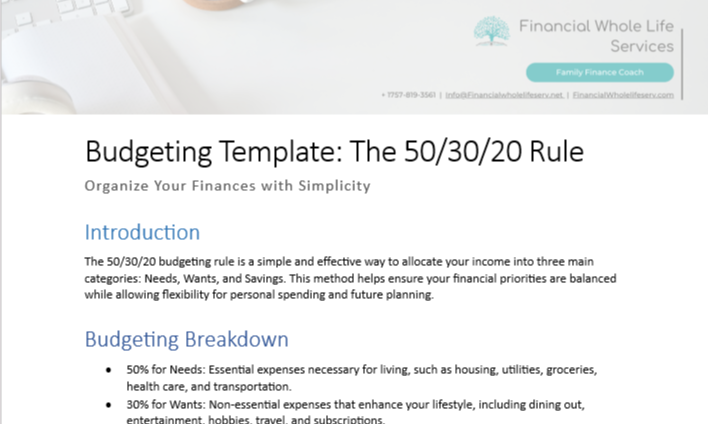

50/30/20 Budget Template – (WORD DOCS)

This tool helps you distinguish between essential needs, desired wants, and savings goals for a balanced financial plan.

Smart Budgeting Tips

Quick Tips to Level Up Your Budget

- Track Every Dollar for 30 Days

- To gain better control of your finances, begin by tracking your spending for the next 30 days. Choose a method that aligns with your lifestyle to make this process easier and more effective. This practice will help you understand your spending habits and identify areas for improvement.

- Reward Yourself

- Remember to celebrate your financial accomplishments! While it's important to allocate funds for fixed expenses and necessities, don't feel limited to spending only in those areas. Allow yourself some flexibility in your budget to enjoy life and treat yourself occasionally. Budgeting should be a positive experience that empowers you, not a source of restriction.

- Weekly Check-Ins

- Start with weekly check-ins to establish a routine for managing your finances. Once you're comfortable, switch to bi-weekly reviews. Aim to check your finances as often as you get paid or at least once a month to ensure fixed expenses are met, variable expenses stay within budget, and periodic expenses are planned effectively. that your fixed expenses are covered, that your variable expenses remain within budget, and that you are adequately planning for periodic expenses.

- Automate Your Savings

- To maintain a healthy savings account, start with an automatic transfer of $20 to $50 each month, and increase it as you become comfortable. Try to avoid withdrawals unless absolutely necessary, and if you do need to access your funds, aim to contribute a little extra the following month to replenish your savings. This will help you achieve your financial goals!